A big day for spot Bitcoin ETFs and BlackRock appears to be the winner on the first day of trading.

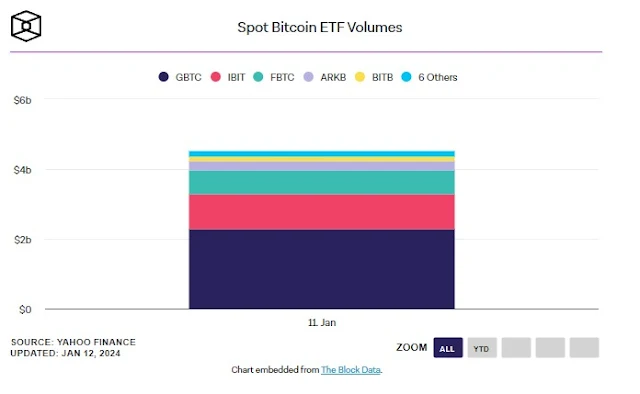

On a day when Bitcoin ETF spot trading volume reached nearly $4.6 billion, BlackRock's fund reached more than $1 billion, according to data from The Block. That makes BlackRock's fund the best-performing fund in terms of volume among the new Bitcoin ETFs. Fidelity's ETF performed second best, raking in $685 million in transactions.

“While it is too early to make a final assessment, this impressive trading volume suggests a significant inflow of investor money into the markets,” said James Butterfill, head of research at CoinShares. Bitcoin ETF spot”.

FIRST DAY OF TRADING

Thursday marked the first day of trading for spot Bitcoin ETFs after being approved by the U.S. Securities and Exchange Commission just a day earlier.

While Grayscale's Bitcoin ETF spot led all funds in trading volume on Thursday, with $2.3 billion, the institutional fund is a carryover from its GBTC fund. Bloomberg Intelligence senior ETF analyst Eric Balchunas speculated that the bulk of Grayscale's volume was likely “all sold” rather than new capital inflows.

Another Bloomberg analyst James Seyffart posted a similar statement on social media platform X.

“It could be argued very easily that the majority of this volume is now being sold [Grayscale's funds] and buying other ETFs,” he said.